Marcum LLP today released the first annual Marcum National Construction Survey. Overall, the survey reflects a positive outlook by respondents about the current and future state of the industry, despite the COVID-19 pandemic.

Influencing their optimism were the ability to secure financing for new projects and to find new sources for building materials, the respondents said. In addition, while job backlogs remain strong, they anticipate the need for diversified supply chains, new worksite safety protocols, and strategic planning to secure new contracts.

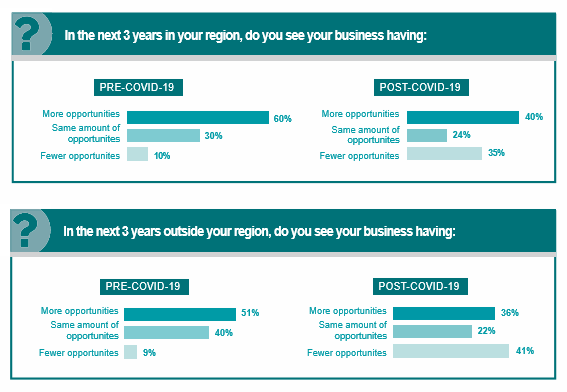

The survey was conducted in the first quarter of 2020 by Marcum’s national Construction Services group, a premier provider of accounting, tax, and advisory services to the construction industry. To account for the influence of the coronavirus crisis, responses were separated into pre- and post-March 15 periods.

Selected Findings

- 90% of respondents reported that their ability to receive project financing has increased or stayed the same as compared to last year.

- 47% of respondents reported banks required bonding on less than 20% of their jobs.

- 82% of pre-pandemic respondents projected either the same or higher backlogs for 2020.

- 67% of post-pandemic respondents projected either the same or higher backlogs.

- Just over a third of respondents (36%) predicted they will increase expenditures in the next year.

- 41% of pre-pandemic respondents chose “securing skilled labor” as the No. 1 threat to their businesses.

- 29% of post-pandemic respondents chose “lack of work” as the No.1 threat.

- 51% of respondents are increasing compensation to address the shortage of skilled labor.

- 85% of respondents said they were applying for loans under the Paycheck Protection Program (PPP) to mitigate the impact of the virus on their businesses.

- 56% of respondents said their top priority going forward is strategic planning.

- 37% of respondents have realized tax savings in the past year, from the Tax Cuts and Jobs Act of 2017.

Joseph Natarelli, Marcum’s national construction industry leader, said, “The industry was well-positioned prior to the pandemic, even with a potential recession looming. Those going into COVID-19 with weaker balance sheets will be negatively impacted. We believe that as long as firms work with their internal teams and professional advisors to address labor safety issues and material sourcing, and have a pandemic plan in place, they will come out of this in good shape.”

Marcum Partner Roger T. Gingerich, regional construction leader for Ohio and survey project manager, said, “When we distributed the survey in early February, the epicenter of the novel coronavirus was in China, an important hub for steel production and general manufacturing, and that country’s subsequent economic shutdown had an immediate ripple effect on the U.S. construction industry that still persists. With the exception of several regional markets hardest hit by the pandemic, where job sites were closed, most U.S. construction workers were deemed essential and have continued to work. In alignment with these developments, positivity among survey respondents began to dip by mid-March.”

“The pre-COVID-19 economy was blissful for many contractors. A combination of strong job growth, technology-induced transformation, and healthier state and local government finances, rising incomes, consumer confidence, low inflation, and minuscule interest rates propelled construction spending higher. The post-COVID-19 economy is the mirror opposite,” wrote Marcum’s chief construction economist, Anirban Basu.

“The second quarter of 2020 is likely to prove the worst quarter of our economic lives. By February, the nation was already in recession. U.S. GDP declined 4.8% for the quarter… Often, construction is spared during the early stages of a broader economic downturn due to a combination of ongoing work and backlog. That didn’t happen this time… Construction’s recovery will be far more rapid if two things occur: 1) federal stimulus directed toward state and local governments to help them balance their budgets; and 2) a federal infrastructure investment package,” he said.

Join the conversation: