New funding expands foundation’s roster of funded partners to 52 organizations offering scalable training programs in dozens of states The Lowe’s Foundation announced nearly $9 million in Gable Grants to strengthen 15 nonprofits on the front lines of a growing skilled trades workforce movement. From Alaska to Mississippi, each organization is helping prepare new tradespeople Read more

Associated Builders and Contractors (ABC)

New funding expands foundation’s roster of funded partners to 52 organizations offering scalable training programs in dozens of states

The Lowe’s Foundation announced nearly $9 million in Gable Grants to strengthen 15 nonprofits on the front lines of a growing skilled trades workforce movement. From Alaska to Mississippi, each organization is helping prepare new tradespeople as rising wages fuel more career opportunities. Over the past 12 months in construction alone, average hourly earnings have risen 4.4%, according to Associated Builders and Contractors.

“We listen closely to contractors and know that many candidates don’t have the necessary skills to fill the wide range of open trades positions,” said Janice Dupré, Lowe’s executive vice president of human resources and chair of the Lowe’s Foundation. “Through modern training methods, these nonprofits are unlocking the workforce’s potential while building an economy that rewards skills, not just titles or four-year degrees.”

Since 2023, the Lowe’s Foundation has awarded over $34 million in Gable Grants to help educate and advocate for the next generation of skilled tradespeople. The grants support training programs focusing on carpentry and construction, HVAC, electrical, plumbing and appliance repair.

“We are grateful for the support of the Lowe’s Foundation and their Gable Grants that will help fund the training of the next generation of skilled trade professionals,” said Jim Tobin, CEO of the National Association of Home Builders. “All of these deserving grant recipients play a pivotal role in helping to strengthen the residential construction workforce, and we stand in support of their efforts.”

The new Lowe’s Foundation Gable Grants support the following community-based nonprofits:

Alaska Works (Anchorage, Alaska) will expand its free, hands-on construction training program in Anchorage, Fairbanks and the Mat-Su region. The expansion includes additional funds for carpentry, plumbing and electrical training to include building maintenance and additional support for participants.

Hope Renovations (Carrboro, North Carolina) plans to double its number of skilled trades graduates by offering more cohorts at its Raleigh and Durham locations. Its pre-apprenticeship program empowers individuals to enter the construction industry while offering critical home repairs for adults aging in place.

Latino Academy of Workforce Development (Madison, Wisconsin) will support various cohorts of students through a bilingual skilled trades program featuring industry-recognized safety certifications, blueprint reading, financial education and more. For over a decade, the nonprofit has worked closely with employers and regional workforce development boards to support over 10,000 individuals in south-central Wisconsin.

Moore Community House (Biloxi, Mississippi) will build on its construction program with an electrical 101 course, specific to residential construction. The nonprofit will also grow its pre-apprenticeship course through modules that introduce masonry, flooring, roof framing, HVAC and plumbing.

Next Step of West Michigan (Grand Rapids, Michigan) will equip its new training facility to continue construction on dozens of tiny and small homes through a seven-week training program. The nonprofit offers on-the-job training and employment opportunities in construction, carpentry and wood product manufacturing.

Nontraditional Employment for Women (New York) plans to recruit and train more than 300 individuals annually for building and construction trades careers. The grant will also support individualized employment plans, peer support and mentoring events as the nonprofit expands its size and operations.

North Alabama Homebuilding Academy (Huntsville, Alabama) will reach hundreds of new aspiring skilled trades students across Alabama through new satellite programs and a 16-session course. The course culminates with a job fair featuring local employers who have immediate hiring needs and is supported by the Huntsville Madison County Builders Association, a chapter of the National Association of Home Builders.

SER Metro-Detroit Jobs for Progress (Detroit) will expand ReBuild Detroit, a free eight-week apprenticeship readiness training program licensed by the state of Michigan. The program offers industry-recognized credentials, including OSHA 30, and career pathways in the skilled trades through SER’s extensive network of employer partners.

Trade Institute of Pittsburgh (Pittsburgh) will increase the capacity of its 10-week, tuition-free masonry and carpentry training program by 25% while exploring expansion beyond Pittsburgh. The grant will also support new instructors and case managers to help remove barriers to employment through holistic services like life coaching and therapy.

Uncommon Construction (New Orleans) will enhance its alumni Career Pathways program, develop certification curriculum for adults and complete renovations to its new training facility. The organization offers on-the-job training to support safe and affordable housing in the area.

Additionally, the Lowe’s Foundation has awarded a Gable Grant to Boys & Girls Clubs of America (BGCA) as a new national nonprofit partner. BGCA will use its grant to enhance skilled trades job readiness programs for young adults (ages 16-24) at three pilot club locations in Hobe Sound, Florida; Madison, Wisconsin; and Seattle.

The foundation has also renewed partnerships with national nonprofits Goodwill Industries International, Local Initiatives Support Corporation (LISC), the National Center for Construction Education and Research (NCCER) and SkillsUSA. These partnerships will continue to support a variety of skilled trades training programs, including wraparound services and targeted workforce development in communities impacted by natural disasters.

The next Gable Grant application cycle for community and technical colleges will run from March 1 to March 31. To learn more about eligibility guidelines and the pressing challenges facing the skilled trades, visit Lowes.com/Foundation.

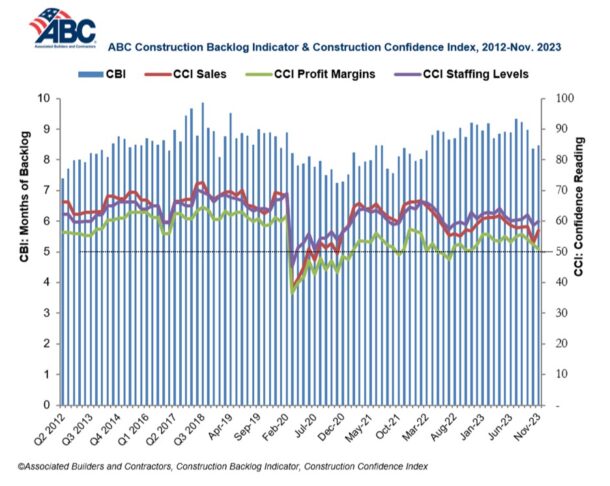

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022. View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for November. View the full Read more

Associated Builders and Contractors reported today that its Construction Backlog Indicator inched up to 8.5 months in November from 8.4 months in October, according to an ABC member survey conducted Nov. 20 to Dec. 4. The reading is down 0.7 months from November 2022.

View ABC’s Construction Backlog Indicator and Construction Confidence Index tables for November. View the full Construction Backlog Indicator and Construction Confidence Index data series.

Despite the monthly increase, backlog is currently 0.8 months lower than at July’s cyclical peak. The sharpest declines over that span occurred among contractors with more than $100 million in annual revenues, who collectively reported fewer than 10 months of backlog in November for the first time since the second quarter of 2018.

ABC’s Construction Confidence Index readings for sales and staffing levels increased in November, while the reading for profit margins fell. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“A growing number of contractors are reporting declines in backlog,” said ABC Chief Economist Anirban Basu. “The interest rate hikes implemented by the Federal Reserve appear to be making more of a mark on the economy. Not only has the cost of capital risen over the past 20+ months, but credit conditions are also tightening, rendering project financing even more challenging.

“The good news is that certain interest rates have begun to fall in anticipation of Federal Reserve rate cuts next year, perhaps as early as the first quarter,” said Basu. “Still, 2024 is poised to be weaker from a construction demand perspective for many firms, especially those that depend heavily on private developers. Those operating in public construction and/or industrial segments should meet with less resistance on average.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months. View the methodology for both indicators.