Homeowners can now pay for projects in monthly installments, while home service businesses continue to get paid as soon as the job is done Jobber, the leading provider of home service management software, today announced a partnership with Wisetack to allow home service businesses to offer financing options to their customers. The new consumer financing feature gives Read more

Jobber

Homeowners can now pay for projects in monthly installments, while home service businesses continue to get paid as soon as the job is done

Jobber, the leading provider of home service management software, today announced a partnership with Wisetack to allow home service businesses to offer financing options to their customers. The new consumer financing feature gives homeowners the ability to pay for jobs such as home renovations, landscaping, roof repairs, a new furnace or air conditioner in monthly installments—giving them more flexibility to pursue large projects or deal with urgent and unexpected repairs. While homeowners will have the benefit of paying over time, home service businesses using Jobber will continue to receive full payment for a job as soon as it’s completed.

“Consumer financing is another way that Jobber is helping home service entrepreneurs meet homeowner expectations, compete with bigger competitors, and ultimately be more successful,” said Sam Pillar, CEO & Co-founder at Jobber. “Jobber’s customers can now offer premium services with more confidence, and homeowners can take on projects and repairs with a convenient and flexible payment option. We’re thrilled to add consumer financing to Jobber’s suite of financial solutions and further empower small businesses to deliver great service to their customers.”

“Jobber’s reach among home services professionals means we can be more accessible to more businesses nationwide,” said Bobby Tzekin, CEO & Co-founder of Wisetack. “We’ve gotten really great feedback from the service providers we’ve worked with so far and we’re excited to empower more businesses with this launch.”

Through Jobber, consumer financing can be automatically offered on residential quotes between $500 and $25,000. To apply for monthly financing, homeowners fill out a short application and receive a decision instantly. Annual percentage rates (APR) range from 0 to 29.9 percent and there are no prepayment penalties, origination fees, late fees, or compound interest applied to the homeowner’s account.*

“My customer was extremely grateful to have this consumer financing option,” said Jobber customer Jeff Kerr, owner and operations manager at Marlin Wastewater Services. “The repair came at a really bad time for her, and she was left with a really good feeling. I think it’s an amazingly easy process, too.”

A Jobber-commissioned survey of 1,000 U.S. adults (age 25+) revealed how important the option of consumer financing is to homeowners, and how this offering could mean the difference between a service professional winning and losing a job. In fact, 62% of respondents said that they would choose one home service provider over another if the business offered monthly financing. Additional findings from the study include:

Encouraging Dream Projects for Homeowners

Sixty-three percent (63%) of homeowners indicated that they would be willing to take on a more expensive project if there was a financing option available to them. More than half of homeowners (54%) have put off a project due to lack of funds, while one in four (25%) have considered borrowing against their 401k for a home improvement project.

Enabling Emergency Repairs

Sixty-six percent (66%) of respondents would be more likely to use monthly financing for emergency work, such as fixing a damaged roof or burst pipe. Nearly one in four homeowners (24%) said they have less than $500 available for emergency home repairs and 39% said they have $1,000 or less. Homeowners aged 45 -54 have the lowest amount of cash available for emergency repairs with more than half (53%) indicating reserves of $1,000 or less.

Younger Homeowners Value Consumer Financing

Throughout the survey, younger respondents (25-34) displayed stronger opinions around the ability to finance home service projects. Eighty percent (80%) would pick a home service provider over another because they offered monthly financing—eighteen points above the overall average. Seventy-seven percent (77%) of homeowners in this age bracket would also take on more expensive projects if they could pay in monthly installments. More than half (53%) have put a home service project on a credit card so they could pay for it over time.

Consumer financing is available to Jobber customers in the U.S. who meet the eligibility requirements and are approved by Wisetack. To learn more about how this feature can benefit your plumbing, HVAC, landscaping or other home service business, visit: getjobber.com/features/consumer-financing/

Jobber’s 2020 Home Service Economic Report highlights the COVID-19 pandemic’s initial impact on Home Service, as well as the category’s path to recovery Jobber, the leading provider of home service management software, today released the Home Service Economic Report: 2020 Review, which showcases market trends and insights pertaining to the performance of the Home Service category Read more

Jobber’s 2020 Home Service Economic Report highlights the COVID-19 pandemic’s initial impact on Home Service, as well as the category’s path to recovery

Jobber, the leading provider of home service management software, today released the Home Service Economic Report: 2020 Review, which showcases market trends and insights pertaining to the performance of the Home Service category throughout 2020. Although Home Service experienced a significant decline in year-over-year growth in March and April when stay-at-home directives were implemented across the U.S., the category ended the year exceeding pre-pandemic growth levels.

According to the report, median revenue in Home Service saw consistent positive growth beginning in June, and reached a record high for the year in December with 23% growth year-over-year. New work scheduled, an early indicator of the health of Home Service businesses, peaked in June with 17% growth year-over-year, then continued to see consistent positive growth throughout the second half of the year.

“While so many small businesses were sadly forced to close shop in 2020, most Home Service businesses endured,” said Sam Pillar, CEO and co-founder of Jobber. “All the major metrics we track for Home Service, including consumer demand, employment and revenue, point to an overall category recovery as we kick off 2021. If 2020 is any indication, service providers are a resilient group that can overcome challenges that may surface in the year ahead.”

Jobber’s Home Service Economic Reports are compiled using proprietary data aggregated from over 100,000 Home Service professionals that use the platform. That data, along with various sources of government data, are used to assess the performance of the Home Service category, and compare it against other major categories (Restaurants, General Merchandise Stores, Automotive, Clothing Stores, and Grocery Stores). The report also provides insights into key segments such as Cleaning, Contracting, and Green; and looks into industry trends related to technology adoption and how they are affecting Home Service businesses’ ability to get work, do work, invoice and get paid.

Key findings from the report include:

- Home Service has proven to be resilient—Despite its initial decline, Home Service has proven to be one of the most stable categories aside from Grocery Stores and General Merchandise Stores amidst economic uncertainty.

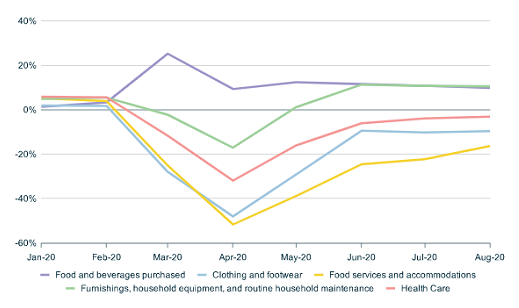

- Consumers spending more on Home Service—Sparked by renewed homeowner interest to improve indoor and outdoor living spaces, consumer spending in Home Service out-performed most major categories in the second half of 2020, compared to the same period in 2019.

- Technology adoption on the rise—Digital work requests saw accelerated growth through 2020 after a decline in March and April. Data also shows an increase in electronic customer communication in the form of visit reminders, which saw 30% year-over year growth in April and May, despite the fact that actual visits declined during this period.

- Online payments continue to grow—Consumer payments with credit and debit cards grew faster than overall revenue growth in the second half of 2020.

- Commercial cleaning outperformed residential—Residential cleaning was the industry most impacted by the COVID-19 pandemic, while commercial cleaning contract work was comparatively stable.

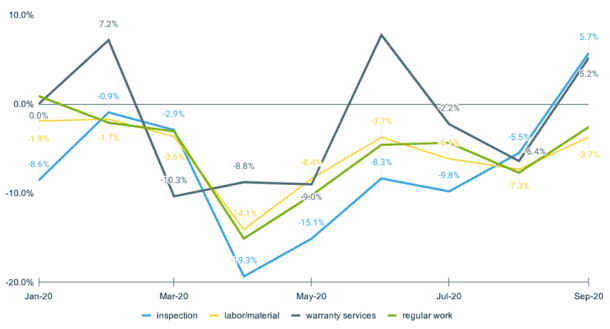

- Contracting warranty services showed stability—Warranty services proved to be the most steady type of work in the Contracting segment while inspection/consultation for new work was the most volatile.

- The Green segment experienced record growth—The Green segment, which includes landscaping, lawn care, and other outdoor services, is the only segment that saw year-over-year growth in median revenue every month during 2020. This growth accelerated in Q4, hitting a record 32% year-over-year growth in December.

“When the COVID-19 pandemic hit back in March, we weren’t sure how our customers’ businesses would perform,” said Abheek Dhawan, VP, Business Operations at Jobber. “Although service businesses experienced record declines at the onset of the pandemic, they managed to weather the storm rather effectively to end 2020 on a positive note. It’s especially promising to see the increase in technology adoption, as it means that not only are service professionals surviving, but also further investing in their businesses. We suspect that the trend towards technology adoption, which has accelerated due to the pandemic, will continue into 2021 and beyond.”

To download the Home Service Economic Report: 2020 Retrospective, visit: https://getjobber.com/home-service-reports/january-2021/

Jobber’s Latest report reveals full quarter of positive year-over-year revenue growth for Cleaning, Contracting, and Green segments Jobber, the leading provider of home service management software, today released the Home Service Economic Report: Summer Edition, which showcases market trends and insights pertaining to Home Service businesses in the first three quarters of 2020. Year-to-date, the Home Read more

Jobber’s Latest report reveals full quarter of positive year-over-year revenue growth for Cleaning, Contracting, and Green segments

Type of Work Performed – Contracting (YoY)

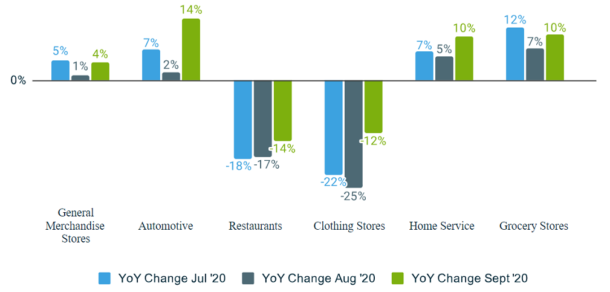

Category Comparison YoY (Q3 2020)

Jobber’s Home Service Economic Reports are compiled using proprietary performance data aggregated from the 100,000+ home service professionals the platform serves. Category performance is also compared to other major categories for context. New to this quarter’s report is data revealing trends in type of work completed, digital payment adoption, and consumer communication. Key findings from the summer report include:

- New Work Finds Pre-Pandemic Success—New-work-scheduled started to show signs of recovery from May onwards, hitting a record high for the year in June with 17% growth year-over-year. The growth continues to look healthy year-over-year in Q3, exceeding pre-COVID levels.

- Employment Growth Sees Upward Trajectory—Compared to Total Nonfarm employment growth, which saw an average decline of around -7% year-over-year in Q3, Home Service fared much better with a decline of around -4%. The category has seen rapid recovery, starting with a decline of -12.9% in April to -4.9% year-over-year in June 2020, followed by continued improvement in Q3.

- Home Service Outperforming Most Categories—With the exception of Grocery Stores and General Merchandise Stores, Home Service was the most stable category through the peak of the pandemic. It has also recovered very well through June and Q3 compared to others such as Clothing Stores and Restaurants.

- Electronic Payments On the Rise—From January to May, there has been a 5% increase in e-payment collection when compared to other methods such as cash or cheque, which can be largely attributed to social distancing measures that came into effect earlier this year.

Consumer Spending Comparison YoY

“Analyzing measures such as consumer demand, employment, and revenues, we see encouraging results for the Home Service category,” said Abheek Dhawan, VP, Business Operations at Jobber. “Home Service businesses have rebounded better than most other categories, and it’s fair to say that businesses and consumers remain optimistic, but cautious, as we enter the final quarter of 2020.”

To download the full Home Service Economic Report: Summer 2020 Edition, visit Jobber Homes Services Report.