Mechanical Hub continues its series of exclusive Q & A sessions with industry leaders and players to get their views on the future, and living in a COVID world, and an insight into the market in 2021.

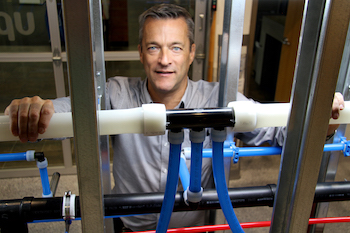

Bill Gray

The American Supply Association released its annual sales report for 2020 and the ASA Pulse sales report shows member distributor respondents enjoyed an average sales growth of 4.4% and a median growth of 6% during the fourth quarter of 2020; however, distributor respondents doing business primarily in the industrial pipe, valves and fittings channel continued to report declines.

Total ASA distributor respondents reported a median 1.4% sales growth for the full year 2020 vs. 2019, and inventory levels rose 4.9% in the fourth quarter of 2020 compared to the fourth quarter of 2019.

This week, Mechanical Hub features Bill Gray, president, Uponor North America to get his company’s pulse for 2021. You get the sense that it’s time to move forward and the time is now to take full advantages of the opportunities that lie ahead.

MH: While putting together the Mechanical Hub annual forecast last year, you were one of the only ones to go on record who took COVID into account in the short-term up until that point in mid-January 2020. What were you hearing?

GRAY: We were starting to hear “noise” in the supply chains. You have to understand, I have a mother in the background who was reading all the articles, warning me about traveling to Europe and Hawaii. What sounds like wisdom from me is actually deriving from my mother yelling in the background to stay home.

MH: Most of the residential guys are doing fine, but there are hiccups with commercial and industrial sectors. What does the short-term economy look like for Uponor? What are the economic indicators telling you?

GRAY: This is a question we try to answer on a weekly or bi-weekly basis with our European parent company. We are currently enjoying a very healthy level of business. In 2020, we hit the brakes in April after a great first quarter. By the end of May, it was all back in a big way. All that demand that fell off, people decided to get that work done. Through Q3, it was good volume.

We knew there was more volume going into residential. For commercial, no one was stopping projects already coming out of the ground. I don’t know when we will see commercial projects begin to tail off. As you know, 12, 18, or 24 months is nothing to get a commercial project rolling. What I am told is that there are fewer projects to quote in commercial order books. Certain segments are more adversely impacted than others. For example, it is hard to imagine you are going to build a new hotel if you haven’t already broken ground.

I am one of those guys who normally spends 75 to 100 nights a year in a hotel. In 2020, I spent maybe 20, and all of those were at the beginning of the year. So that challenge to commercial will keep getting pushed forward. They will still need to perform retrofits, and that might open up some opportunities.

Residential is on fire, supported by demographic demand that has been held back. We often speak of “natural” household formations coming in at 1.5 million annually. We never achieved that level coming out of the past recession, so the demand gets pushed forward. Meanwhile, existing homes valued between $250,000 and $500,000 are going for the asking price or higher and don’t last very long at all on the market. Builders of new homes are building into their 2022 and 2023 land plans currently.

One of the factors that may bring down that activity is that builders cannot get land fast enough, as they burn up all of their lots now. So, we are in a window now, and everyone is building homes as fast as they can, and prices are slowly climbing. Input prices are crazy. Truss packages—nobody builds trusses on the job site anymore—are going for 3X or 4X vs. 2020 levels. Insulation deliveries are crazy; all the HVAC and mechanical stuff—crazy. Our friends over at Bradford White are at six to eight weeks currently.

There is demand out there. RWC just released their numbers, but had great sales growth last year with more exposure to DIY through Home Depot and Lowe’s. We know the latter pair are doing very well. We are seeing a lot of switch-in-spend right now. “I cannot go on vacation, so I am going to work on my house and yard.” Many cannot get a contractor to do the work, and if they do, the pricing can be very high. “I’m willing to take the work, but it will cost you.”

MH: As far as inventories and supply, how is Uponor faring?

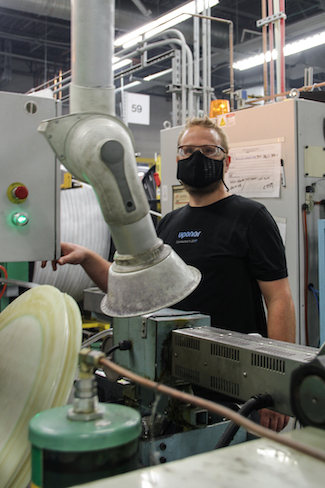

GRAY: We shut down the plant for eight days in April and laid off some staff in distribution and manufacturing. We have them back, plus. We are up to a month behind right now against a strong order volume. We were famous for delivering our product on time and in full. The problem definitely relates more to residential—smaller-diameter pipe.

It is what it is right now, but I question how long this activity can be sustained. Most companies, from what I have read, are saying like the first half, maybe through Q3 2021. But there is no election this year. We will see what happens with the stimulus packages. Do they finally do something on infrastructure? We need infrastructure work—now is the time to do those projects. Money will never be cheaper, nor labor more plentiful. But if you wait until a full economy, the challenges will be much greater.

I think if the federal government plays this right, understanding the dynamics of the market today—like in 2008-09, shovel-ready projects that will keep the economy going—I think construction could be really good—or really challenging. A lot of variables have not played out yet.

MH: How are you steering the ship to deal with COVID? You have gotten through 2020, is it all systems go? Anything different?GRAY: What we did as well as or better than anyone else—not just in our industry, but in other industries too—is that we got on top of the problem early with our COVID Task Force. Originally, we were focused on problems in the supply chain, but that transitioned very quickly to our employees’ health and safety, as COVID hit the United States. We started looking at where our employees were traveling for work, creating an awareness, telling them if you are going to an area that may be compromised, be sure you are taking the proper precautions for yourself and your colleagues.

We were able to keep the plants open, because we were designated—along with most of new-construction markets and building products—as essential services. We have been promoting health and safety first, then the continuity and integrity of our factories, making sure we are able to ship products to customers. That is how we cascaded these priorities.

At Uponor, we went virtual on Friday, March 13, 2020, with the idea that we should test our systems in case we must work from home at some point, and everything worked out well from an IT perspective. As it turned out, ironically, the mandate to work from home came down over that weekend.

Next, we did a live migration to Microsoft Teams, which was a huge improvement over our previous platform.

As the situation has “stabilized” now—as much as it can be stabilized—we are continuing monthly calls with all employees. The leadership team and I continually explore what’s new, what’s different? When can we expect to come back to the office? What’s coming back going to look like? We try to manage all that.

From my perspective, we won’t be coming back to anything normal probably until 2022. My boss from Finland visited the United States the week before the AHR Expo in 2020. I don’t expect to see him in the United States at all in 2021. It’s been spotty in that part of the world, although with their stronger central governments, they seem to have managed COVID more effectively. Their countries haven’t had the same levels of infection. My next trip to Europe may be Q1 of 2022. By then, I should have the vaccine, I am confident.

The big unknowns on the horizon are the variants of COVID and whether the vaccines will help prevent their spread. Or is our future more pandemics? I don’t know right now.

MH: Lat month, Uponor launched its new Complete Polymer Solution for commercial-piping applications in the U.S. How do you manage a launch like this in the midst of a pandemic and the cancellation of a major trade show?

GRAY: We did a soft launch around the announcement of the relationship with Pestan at the AHR Expo in 2020. We understood the amount of work that lay in front of us. For a company like Uponor to launch a product line of this magnitude, it is a major endeavor.

Which is why I have such an appreciation for our team and their ability to pivot at every opportunity, figuring out just how we would get all the work done. We knew the objective; we knew the amount of work we had to do. But there was a tremendous amount of creativity to making it all happen. Working with our health and safety people, our team developed a protocol for how we would do all this work internally while maintaining proper social distancing.

Then, with the launch itself, there is a lot to going virtual. It may look like it’s going rather smoothly. But when you see the machine behind the people, and how it makes this all work, you can’t help but be impressed. I did my on-camera interview a couple of weeks ago, and at the time it feels like a disparate collection of takes and cuts. But they brought it all together through an editing process that makes even me look good. That’s a pretty tall order!

MH: The market for this PP-RCT launch right now: Is it targeted for domestic water as well?

GRAY: We believe the best opportunity is mechanical. Pursuing domestic water would fragment our efforts. If we focus on mechanical and get really good at that, we can start taking on plumbing. Plumbing is more complex than mechanical; there are different dynamics at play. We think this is the best strategy for us right now. If you are a small company without much of a brand, you can do a lot more across more markets without much risk. If Uponor puts its name on something, we want to make sure we have it right, so our customers are confident it will work.

That is part of the leverage we are providing. If Uponor is offering these products with the full bundle of support—the national rep network, our knowledgeable sales force, on-site training and technical support—the customer can feel better about getting involved. We just felt plumbing would fragment our efforts too much.

Join the conversation: